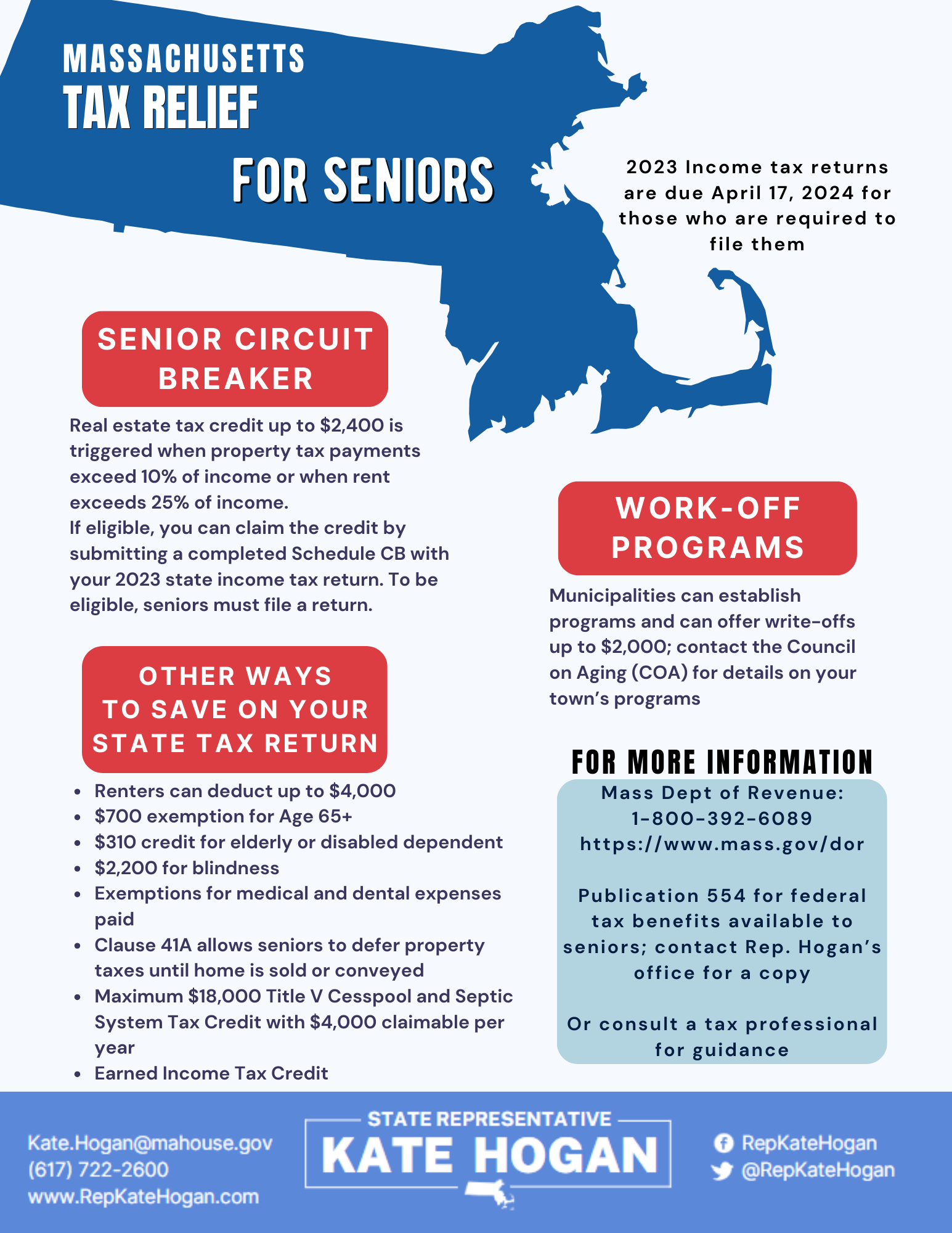

Following is information from the Office of Rep. Hogan about programs and policies that may save our seniors and their families some money during the 2023 tax filing process, including updated information from the tax relief package recently passed by the Legislature.

2023 income tax returns are due April 17, 2024 for those who are required to file them.

Senior Circuit Breaker Tax Credit: Whether you rent or own your primary residence in Massachusetts, income-eligible seniors can receive meaningful relief on their property taxes with a credit based on your real estate tax bill. Under the recent state tax relief legislation, this benefit will double from $1,200 to up to $2,400 per year. To see whether you meet the eligibility requirements, visit: https://www.mass.gov/info-details/massachusetts-senior-circuit-breaker-tax-credit

Property Tax Work-Off: Massachusetts offers two tax work-off programs for qualified homeowners to reduce their property tax bill by volunteering for the community in which they live. The Senior Citizen Tax Work-Off is available to senior citizens 60 years of age or older, while the Veterans Tax Work-Off is offered to any veteran property owner. Each municipality has the option of establishing a tax work-off program and setting requirements. The recent state tax relief package stipulates that municipalities can now offer write-offs of up to $2,000. Contact the Council on Aging (COA) for details on your town’s programs.

Title V Cesspool and Septic System Tax Credit: The recent state tax relief legislation triples the maximum tax credit for Title V cesspool or septic system users to $18,000 and increases the amount claimable to $4,000 per year.

Earned Income Tax Credit: The recent state tax relief legislation increases Massachusetts’ earned income tax credit for taxpayers in the state who earn less than $57,000 per year.

Rental Deduction Cap: Under the recent state tax relief legislation, Massachusetts renters can now deduct up to $4,000 of their rent from taxes each year – an increase of $1,000 from the previous cap.

Additional Exemptions for Seniors: The Massachusetts Department of Revenue offers tax exemptions for residents aged 65 or older, as well as for blindness, medical and dental expenses, Veteran status, and many government pensions. More information is available at: https://www.mass.gov/doc/dor-tax-tips-for-seniors-and-retirees/download

Property Tax Deferral: The senior property tax deferral program, known as Clause 41A, allows people 65 or over to defer their property taxes until their home is sold or conveyed. Contact the Town Assessor for information on eligibility and applying.

Publication 554: This is a booklet that explains all of the benefits available to seniors at the federal level and what the eligibilities are. You can download a copy of Publication 554 at https://www.irs.gov/forms-pubs/about-publication-554, or call Rep. Hogan’s District Director Karen Freker at 617-722-2600 (option #2) for a copy.

Please do not hesitate to contact the Office of Rep. Hogan (617-722-2600) or your local Council on Aging if you need assistance taking advantage of some of these programs.